Understanding Foreclosure In Illinois: What You Need To Know

Buying a house in foreclosure in Illinois can be a great way to save money, but it is important to understand the process before agreeing. The first step is understanding the legal definition of foreclosure.

In Illinois, foreclosure occurs when a homeowner fails to make payments on their mortgage, and the lender begins the process of seizing property and selling it to recoup their losses. Once a foreclosure has been filed, the homeowner no longer has the right to stay in or maintain their home, and they must immediately leave.

It is important to note that this process can take months, during which time the homeowner may still be responsible for paying taxes and utilities. When purchasing a house in foreclosure, buyers should also be aware that they will not receive any warranties on the property or any guarantees as to its condition.

Additionally, buyers should research all laws related to foreclosures within Illinois prior to agreeing, as there are certain protections afforded by law that could impact your purchase. Finally, it is essential that buyers thoroughly inspect any potential home before agreeing to purchase it, as you will not be entitled to any repairs after closing on a foreclosed property.

Knowing these key points beforehand can help ensure you find success when buying a house in foreclosure in Illinois.

Table Of Contents

1. Understanding Foreclosure In Illinois: What You Need To Know

2. The Impact Of Foreclosure On Homeowners In Illinois

3. Selling A Home During The Foreclosure Process In Illinois

4. Tips For Maximizing Profit When Selling A Home In Foreclosure In Illinois

5. Tax Implications Of Buying And Selling A Property Through The Foreclosure Process In Illinois

6. What Happens When Your House Goes Into Foreclosure In Illinois?

The Impact Of Foreclosure On Homeowners In Illinois

Foreclosure can have a devastating impact on homeowners in Illinois. With foreclosures often come significant financial losses and the potential for damage to their credit score.

Once a homeowner is in foreclosure, they are at the mercy of the lender and their own resources. Even if the lender allows them to stay in their home until an auction, they may be unable to keep up with payments, which would result in them having to vacate the property prior to selling it.

The homeowner can also suffer long-term repercussions, such as difficulty obtaining future loans or housing. Foreclosure can be a difficult process that requires careful planning and consideration of all possibilities before committing to selling a house in foreclosure in Illinois.

How To Avoid Losing Your Home To Foreclosure In Illinois

When it comes to avoiding foreclosure in Illinois, the first step is to understand the process from start to finish. Educating yourself on the state’s foreclosure timeline and laws will help you make informed decisions about how to protect your home best.

It is also important to keep up with payments and be aware of any mortgage assistance programs available that could help you keep your house. If you do fall behind on payments, contact your lender immediately, as they may be willing to work out a payment plan or even temporarily postpone payments while you get back on track.

You can also consider selling your home if it is no longer feasible for you to stay in it. Selling a house in foreclosure can be complicated, but there are options available, such as short sales or deed-in-lieu of foreclosure.

Make sure to consult a knowledgeable realtor and financial advisor for advice before choosing a path that works best for you and your family’s unique situation.

Navigating The Foreclosure Process In Illinois

Navigating the foreclosure process in Illinois can be daunting. Knowing what to do and when to do it is key to the success of selling a house in foreclosure.

Before beginning the process, it is important to understand Illinois state law. This includes researching details such as deadlines, allowable fees, and the timeline for different stages of foreclosure.

Additionally, a person should have a clear understanding of their rights as a seller during the foreclosure process, including notification requirements and options for redemption. Once familiar with Illinois law, it is wise to consult with an attorney who specializes in real estate law.

A lawyer can help navigate through any complex legal issues that may arise during the sale of a foreclosed property. Furthermore, having an attorney review all documents related to the sale will ensure that all parties involved are protected and that all necessary steps have been taken.

Finally, if possible, it is beneficial to contact other professionals, such as realtors or lenders who have experience dealing with foreclosures in Illinois. These individuals may be able to provide valuable insight into navigating the foreclosure process more effectively.

Selling A Home During The Foreclosure Process In Illinois

Selling a home during the foreclosure process in Illinois can be a complicated endeavor. Understanding the laws and regulations surrounding foreclosure is essential to ensure you get the best deal for your house.

The foreclosure process in Illinois begins with a notification from the lender, usually in the form of a written notice. This notice will provide information on how much time you have to respond and what options are available to you.

Before proceeding with selling your home, it is important to review the laws governing foreclosures in Illinois since these laws may change from year to year. You should also be aware of any additional documents that may be required, such as an affidavit or proof of ownership.

Once all necessary paperwork has been completed, it is then time to list your property for sale. It is important to remember that even though the house may be in foreclosure, you still need to take steps to ensure potential buyers are interested.

This includes providing detailed information about features and amenities, staging the house for showings, and pricing it competitively so that it stands out in comparison with other similar homes on the market. Finally, once offers have been received, you should consult an attorney before accepting any offers, as they can help negotiate terms that work best for everyone involved.

Steps For Selling A House In Foreclosure In Illinois

If you’re looking to sell a house in foreclosure in Illinois, there are certain steps you need to be aware of. Firstly, it is important to understand the laws and regulations surrounding foreclosures in the state.

You’ll need to research your rights and obligations as a seller thoroughly. Secondly, it is essential that you have all necessary paperwork ready for sale, such as documents related to the homeowner’s mortgage and title deed.

To ensure a smooth transaction, it is also advised that you hire an experienced real estate attorney who can help guide you through the process. After all of the paperwork has been completed, you may want to consider listing your property with an experienced real estate agent who knows how to market homes in foreclosure.

Finally, once potential buyers start expressing interest in your property, be sure to negotiate fair terms for both parties. By following these steps, you can properly sell a house in foreclosure in Illinois with confidence and ease.

Advantages And Disadvantages Of Selling A House In Foreclosure In Illinois

When selling a house in foreclosure in Illinois, both advantages and disadvantages must be considered. One major advantage to this type of sale is that the seller can potentially get a good price for their property.

Since buyers know that they are buying at a discounted rate, they may be willing to pay more than the market value for the property. Additionally, since foreclosure sales often happen in a short amount of time, it can be beneficial for those who need to move quickly or want to avoid lengthy negotiations with potential buyers.

However, there are some risks associated with selling a house in foreclosure. Buyers may be hesitant due to the stigma of purchasing a foreclosed home, which can lead to fewer offers or lower prices than expected.

Moreover, it is important to ensure that all relevant paperwork is in order before listing the property, as errors or discrepancies could delay or even derail the entire process. Ultimately, individuals considering selling their home in foreclosure should weigh both pros and cons carefully before making any decisions.

Tips For Maximizing Profit When Selling A Home In Foreclosure In Illinois

If you’re looking to maximize profit when selling a home in foreclosure in Illinois, there are several important tips you should keep in mind. First, understand the foreclosure process and all of its potential legal implications.

Make sure you know the timeline for the entire process and are aware of any state laws that might affect your sale. Knowing the value of the home is also essential; research comparable properties to estimate what a fair price would be.

Additionally, consider working with an experienced real estate agent who can help you navigate through the sale process. They can provide expert advice on pricing and marketing strategies to help ensure a successful sale.

Finally, have patience; it may take some time to find a buyer willing to purchase a foreclosed property at a price you’re comfortable with. By following these simple tips, you’ll greatly improve your chances of getting top dollar when selling your foreclosure in Illinois.

Closing Costs When Selling A House In Foreclosure In Illinois

When selling a house in foreclosure in Illinois, closing costs can be substantial. Generally speaking, the seller is responsible for most of the costs associated with the sale of their home.

This includes the mortgage payoff, title search fees, any outstanding tax liens or judgments owed by the seller, a deed transfer fee, and an attorney’s fee if needed for legal advice. The buyer will likely be responsible for their own attorney’s fees and any financing-related costs, such as loan origination fees.

It’s important to get these costs in writing prior to signing any documents so that both parties are aware of who is responsible for what and there are no surprises at closing time. It’s also important to factor in all of the closing costs into the total cost of buying or selling a house in foreclosure in Illinois since it can add up quickly.

Knowing what to expect ahead of time can help make sure that everything goes smoothly when it comes time to sell your home.

Finding Buyers When Selling A House In Foreclosure In Illinois

When trying to sell a house in foreclosure in Illinois, it is important to know where to find the right buyers. To start, look for buyers that specialize in purchasing foreclosed properties.

They may be able to offer more than a regular buyer and provide additional resources needed during the foreclosure process. Additionally, consider local investors who are likely looking for bargains and can often close quickly.

It’s also beneficial to create a list of potential buyers from your own network, such as family members or friends who may be interested in investing. Additionally, advertising the property on online listings like Zillow can help you reach out to buyers from across the country.

Finally, contact real estate agents in your area who have experience selling foreclosures and working with banks since they can offer guidance and support through the entire process.

Working With Realtors To Sell A House In Foreclosure In Illinois

When selling a house in foreclosure in Illinois, working with a realtor can be an invaluable asset. Realtors have experience and knowledge about the local market and can help guide you through the process from start to finish.

They are familiar with all the requirements necessary for foreclosure sales, including paperwork, negotiations, and marketing strategies to maximize the sale price. Additionally, they have access to resources that may be unavailable to you as an individual seller.

A realtor can provide you with a comprehensive list of homes currently on the market in Illinois and can work closely with lenders or banks to ensure that all paperwork is properly filed and completed. By taking advantage of their expertise, you will be able to put your property in the best position possible for a successful sale.

Understanding The Timeline For Selling A House In Foreclosure In Illinois

Selling a house in foreclosure in Illinois can be a complicated process. Knowing the timeline and understanding the steps involved are key to ensuring that everything goes smoothly.

It is important to be aware of any deadlines or timelines associated with the sale. Generally, sellers must start by notifying potential buyers of their intention to sell and filing an appropriate notice with the court.

Once this is done, the seller must then wait for approval from the court before proceeding with the sale. Additionally, it is important to understand that there may be additional legal requirements associated with selling a house in foreclosure in Illinois, which could delay the process.

As such, it is wise to research all relevant laws and regulations prior to beginning the sale process. Furthermore, lenders must also grant their approval for any proposed sales, which can add time delays as well.

In some cases, lenders may even require that certain repairs or improvements be made before they approve a sale, so it is best to be aware of these requirements before taking any action. Finally, once all parties have approved the sale and all relevant documents have been filed, closing typically occurs within 30 days of acceptance of an offer from a buyer.

Financing Options When Purchasing A Home In Foreclosure In Illinois

When looking to purchase a home in foreclosure in Illinois, it’s important to understand the different financing options available. Those who are looking for a loan from their bank or mortgage lender will need to provide proof of income and creditworthiness in order to qualify.

Additionally, buyers should be aware that many lenders may require a larger down payment when buying a foreclosed property due to the higher risk involved. Other financing options include government-sponsored programs such as FHA loans or VA loans, which offer more lenient terms and requirements for borrowers.

Cash buyers may also be able to negotiate a lower price with the seller, as this eliminates the need for additional paperwork and fees associated with obtaining a loan. No matter which option is ultimately chosen, it’s important that buyers do their research beforehand and take all necessary precautions when purchasing a home in foreclosure in Illinois.

Tax Implications Of Buying And Selling A Property Through The Foreclosure Process In Illinois

When buying or selling a property through foreclosure in Illinois, it is important to understand the tax implications. The Illinois Department of Revenue requires that all real estate transactions include transfer taxes and other fees, which must be paid by the buyer or seller.

Transfer taxes are calculated based on the assessed value of the property and any improvements made to it. There may also be capital gains taxes if the seller has owned the property for more than one year.

In addition, any back taxes due must be paid by either the buyer or seller prior to closing on the sale. Lastly, when a property is sold at a foreclosure auction, any deficiency remaining between what was owed and what was recovered must be reported to the IRS as income by the debtor who lost their home.

Knowing the tax implications associated with buying and selling a home through foreclosure in Illinois is essential before entering into such an agreement.

Strategies To Help Shorten The Length Of Time It Takes To Sell A Property Through The Foreclosure Process In Illinois

When attempting to sell a house through foreclosure in Illinois, certain strategies can be employed to help expedite the process and shorten the length of time it takes. Of primary importance is understanding the laws associated with foreclosure in Illinois and being aware of the timeline for the completion of all necessary steps.

It is essential that all paperwork is completed properly and filed in a timely manner to ensure that nothing delays the sale. Additionally, securing legal assistance from an experienced attorney can be beneficial during this process.

As foreclosures often involve negotiation between buyers and sellers, having an experienced negotiator on your side can make a difference in achieving a favorable outcome. Additionally, setting realistic expectations for what you will receive from the sale, as well as factoring in any additional costs or fees associated with the sale, will allow you to better plan ahead for how much money you may receive from the transaction.

With careful planning and effective strategies, selling a house through foreclosure in Illinois doesn’t have to be an overly lengthy process.

Common Mistakes Made By Sellers When Going Through The Foreclosure Process In Illinois

When selling a house in foreclosure in Illinois, it’s important to be aware of common pitfalls and potential mistakes that can arise. Unfamiliarity with the foreclosure process in Illinois may lead to costly errors or time-consuming delays.

One of the most frequent mistakes is failing to understand the intricate paperwork involved in a foreclosure. Properly filing all documents, such as deeds, mortgages, and foreclosure notices, is essential for a quick and successful sale.

Another mistake often made by sellers is not understanding their rights as a homeowner during the foreclosure process. Knowing what to expect from lenders and other parties involved can help avoid unnecessary stress and confusion.

Furthermore, some sellers may not be aware of the tax implications associated with selling their home in foreclosure and could potentially end up owing more money than they anticipated. Having a good understanding of this area prior to selling can help ensure that there are no unpleasant surprises at closing time.

How Long Can You Live In A Foreclosed Home In Illinois?

When selling a house in foreclosure in Illinois, it is important to know how long you can live in the home before leaving. According to the Illinois Foreclosure Law, a homeowner may remain in their property until its sale at public auction; however, once the sale of the property is confirmed by court order, then the homeowner must surrender possession within seven days.

If they do not vacate within that time period, they may be subject to fines and eviction proceedings. If any tenant or occupant remains on the premises after this deadline has expired, they may also be held liable for damages caused by their occupancy.

It’s important to remember that if you are living in a home while it is going through foreclosure, you should continue making payments and keeping up with all other obligations to avoid further legal action from your lender or mortgage servicer.

What Happens When Your House Goes Into Foreclosure In Illinois?

When your house goes into foreclosure in Illinois, it means that the lender has taken legal action to take possession of your home and sell it to try and satisfy the balance owed on the loan. The foreclosure process begins when the borrower fails to make timely payments on their mortgage.

Once a Notice of Default is filed, a homeowner has three months to pay off the loan or they will be subject to foreclosure proceedings. In Illinois, there are two types of foreclosures: judicial foreclosure and non-judicial foreclosure.

Judicial foreclosures require court intervention and can take longer than non-judicial foreclosures, which can usually be done in about six months. If you are unable to make payments on your loan, it’s important to consult with an experienced attorney who can help you understand all of your options for selling a house in foreclosure in Illinois.

An attorney can also help you negotiate with lenders so that you can get the best deal possible from them. Additionally, they may be able to help you find alternative methods for selling your house before it goes into foreclosure.

How Long Do You Have To Move Out After Foreclosure Auction In Illinois?

The foreclosure process in Illinois can be a tricky and lengthy one. Depending on the circumstances of the property, the homeowner may have anywhere from 14 days to 6 months to move out after a foreclosure auction.

It is important to educate yourself about the specifics of selling or buying a house in foreclosure in Illinois so that you are aware of your rights during this process. In some cases, you may receive an order to vacate within 14 days of the sale, while other times, you will have up to six months before you must vacate.

Knowing what to expect ahead of time can help prepare you for any necessary paperwork and relocation plans that need to be made during this transition period. Additionally, it is important to consult with an attorney who specializes in foreclosure law as they will be able to provide legal guidance throughout this process if needed.

How Do You Buy A Foreclosed Home In Il?

Buying a home in foreclosure in Illinois can be a great way to get a good deal on a property. Before you start the process, however, there are some key things you need to know. First, make sure you understand the different types of foreclosures available in IL.

A judicial foreclosure requires the lender to file a lawsuit against the borrower and is the most common type of foreclosure in Illinois. A non-judicial foreclosure, on the other hand, does not require court action and is more likely to be used if only one mortgage is involved. Once you know which type of foreclosure applies to your situation, do your research to find out when and where properties become available for purchase.

You should also familiarize yourself with applicable laws and regulations so that everything goes smoothly during the transaction. When you’re ready to make an offer on a foreclosed home in IL, remember that it’s important to act quickly as these properties often receive multiple offers from interested buyers. Make sure your offer is competitive and include any contingencies or conditions that must be met before closing on the property.

Finally, it’s essential that you hire an experienced real estate agent who can guide you through every step of the process from making an offer to signing closing documents. With their help, you’ll be able to buy your dream home at an affordable price without any surprises or problems along the way!

What Do You Have To Lose? Get Started Now…

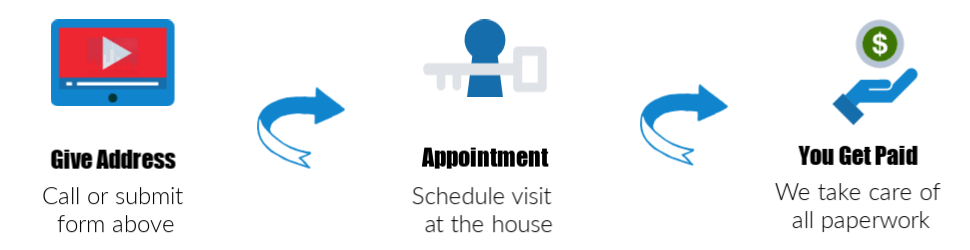

We buy houses in ANY CONDITION in Chicago. There are no commissions or fees and no obligation whatsoever. Start below by giving us a bit of information about your property or call (224) 549-2260 …

| FORECLOSURE DEFENSE | FORECLOSING | MORTGAGE FORECLOSURE | LEGAL SERVICES | LAWYERS | ATTORNEYS |

| LENDING | MORTGAGE LENDERS | JUDGEMENT | LUXURY | SHORT SELL | PRINCIPAL |

| REPAYMENT | EQUITY | SUMMONS | SUING | LAWSUITS | LITIGATION |

| DEFICIENCY JUDGEMENT | EVICTION NOTICE | EVICTED | CONTRACTS | BANKRUPTCY | |

| BANKRUPTCY LAW | SUMMARY JUDGEMENT | REFINANCE | REFINANCING | LOAN MODIFICATIONS | LATE FEES |

| INTEREST RATES | FSBO | FOR SALE BY OWNER | CREDIT HISTORY | CREDIT REPORT | CHICAGO |

| PHONE | MEDIATION | MEDIATOR | HOMELIGHT | DEFAULT JUDGMENT | COVID-19 |

| COVID | BREACH | TRIAL | REAL ESTATE INVESTORS | PROMISSORY NOTE | DEED IN LIEU OF FORECLOSURE |

| STOPPING FORECLOSURE | COMPLAINT | COMPANY | TOOL | TERMS OF USE | SHERIFF |

| PROPERTY RIGHTS | PRIVACY POLICY | PRIVACY | LOSS MITIGATION | LAW FIRM | GRACE PERIOD |

| FORBEARANCE | EXPENSES | CLOCK | CALIFORNIA | BANK ACCOUNTS | TO THE LENDER |

| CAN I SELL | YOU CAN SELL | MISSED MORTGAGE PAYMENTS | A REAL ESTATE | TO AVOID FORECLOSURE | A SHORT SALE |

| OF THE FORECLOSURE | SO YOU CAN | WITH YOUR LENDER | STOP THE FORECLOSURE | OF THE FORECLOSURE PROCESS | IN LIEU OF FORECLOSURE |

| CAN I SELL MY | SHORT SALE A SHORT | A DEED IN LIEU | A REAL ESTATE AGENT | DEED IN LIEU OF | SALE A SHORT SALE |

| YOU CAN SELL YOUR |

Donald Montoya, Satisfied Customer in Midlothian.

Donald Montoya, Satisfied Customer in Midlothian.

Alfred Richardson, Satisfied Customer in Olympia Fields.

Alfred Richardson, Satisfied Customer in Olympia Fields. Lisa Porter, Satisfied Customer in Naperville.

Lisa Porter, Satisfied Customer in Naperville.