What Is Probate Real Estate In Illinois?

Probate real estate in Illinois is property owned by someone who has passed away, and that person’s will states how the property should be distributed. Before a probate court can approve the distribution of the property, it must first determine if all heirs have been located and if any debts are owed to creditors.

If there are no outstanding debts, then the court will issue an order authorizing the executor of the estate to begin selling off assets, including real estate. Selling a house in probate in Illinois requires knowledge of probate laws and experience with marketing techniques that can attract potential buyers.

It is important to understand how to price the home correctly based on market conditions, as well as make sure all necessary paperwork is completed properly during the transfer of ownership. For those looking for strategies to sell a house in probate in Illinois, working with a qualified agent or attorney may be beneficial to ensure all steps are taken correctly and efficiently.

Table Of Contents

1. What Is Probate Real Estate In Illinois?

2. Understanding The Probate Process In Illinois

3. Common Pitfalls Of Selling A House During Probate In Illinois

4. Pros And Cons Of Selling A Home During Probate In Illinois

5. Overview Of Laws Relating To Disposition Of Real Estate In An Estate In Illinois

6. What Are The Steps For Closing On A House After A Probate Sale In Illinois?

7. Who Owns A House During Probate In Illinois?

Understanding The Probate Process In Illinois

Selling a house in probate in Illinois can be a daunting process, but understanding the probate process in Illinois is essential for success. Probate is the legal process by which an estate is settled after the death of a person.

In order to begin the probate process, an executor must be appointed and approved by the court. After that, all assets of the deceased must be identified and inventory taken before it can be distributed to beneficiaries according to state law.

Additionally, any debts or taxes owed must also be paid before the estate can be closed. When selling a house in probate, certain forms must be filed with the court to provide notice to potential buyers and creditors that the property is being sold.

The executor of the estate must also obtain court approval for any offers made on behalf of the deceased before closing on a sale. Understanding these steps in advance will help ensure that everything goes smoothly when selling a house in probate in Illinois.

How To Prepare A House For Probate Sale In Illinois

When selling a house in probate in Illinois, it is important to be prepared and understand all of the steps involved. To maximize the success of a probate sale, sellers should start by ensuring that all necessary documents are organized and in order.

This includes any deeds, title certificates, tax bills, homeowner association documents, insurance records, and more. Next, sellers should take measures to make their property as attractive as possible to potential buyers.

This could include updating fixtures or appliances, adding new landscaping features, freshening up the paint job inside and out, and decluttering to make the spaces feel larger. Additionally, it is important to establish realistic pricing for the house based on comparable sales in the area.

Lastly, ensure that there is ample marketing of the property so that it reaches as many interested buyers as possible. By following these steps when preparing a house for probate sale in Illinois, sellers can maximize their chances of making a successful sale.

Executor Responsibilities In An Illinois Probate Sale

When selling a house in an Illinois probate sale, the executor of the estate has certain responsibilities to ensure that the process runs smoothly. These include obtaining court approval for the sale, researching and hiring a real estate agent or attorney who specializes in probate sales, reviewing offers from potential buyers, managing escrow accounts associated with the sale, and making sure that all legal documents are completed and filed on time.

The executor should also be prepared to answer questions from potential buyers about the condition of the house as well as any repairs or upgrades that have been completed since the death of the homeowner. Finally, it is important for the executor to keep detailed records of all transactions related to the probate sale so that they can prove their compliance with state laws.

Selling a house in an Illinois probate sale requires knowledge and dedication from both the executor and other members of the family involved in order for it to be successful.

Common Pitfalls Of Selling A House During Probate In Illinois

When it comes to selling a house in probate in Illinois, there are some common pitfalls that sellers should be aware of. The process of transferring a house from one owner to another is a complicated one, and mistakes can be costly.

During probate, the executor of the estate oversees the transfer and sale of assets, including property. It is important for potential buyers to understand all paperwork involved in the transaction, as well as any applicable taxes or fees.

Additionally, if the home needs repairs or updates before being sold, this must be taken into consideration when making an offer. Lastly, it is important for sellers to research their local housing market to ensure they are getting a fair price for their property during probate.

Taking time to understand these common pitfalls can help ensure a smooth and successful transaction when selling a house in probate in Illinois.

Pros And Cons Of Selling A Home During Probate In Illinois

Selling a home during probate in Illinois can be a complicated process, but it can also provide an opportunity for a family to maximize the value of their estate. Before deciding to sell a home during probate, it is important to weigh the pros and cons of this strategy.

On the upside, selling a home during probate can allow for maximum exposure to potential buyers since all potential buyers will be aware of the property’s availability. Additionally, with proper planning and legal guidance, families may be able to reduce or avoid some of the costs associated with selling a home.

However, there are some drawbacks to consider as well. The probate process can be lengthy and complex as it requires obtaining court approval before any sale is finalized.

There may also be extra costs associated with transferring the title from the deceased estate owner’s name into that of the buyer. Finally, families should keep in mind that if they are unable to find a buyer quickly enough, they may have difficulty meeting court deadlines, which could result in additional fees or delays in closing on the sale.

When Does Real Estate Need To Go Through Probate In Illinois?

In Illinois, real estate needs to go through probate if the deceased left behind a will. If no will is present, the estate must be settled through an intestate succession, which is determined by the state’s laws of descent and distribution.

Probate in Illinois is necessary when a person dies and owns real estate or other property in their sole name as it is required to transfer the title of the property from the decedent to the heirs or beneficiaries. The court will review all claims made against the estate and, if approved, distribute assets according to the will or state law.

All debts must be paid before any remaining assets are distributed. Probate can sometimes take a few months or more, depending on how complicated the estate may be and any disputes that may arise.

When selling a house in probate, it’s important to understand all of your rights and obligations as an executor so you can complete all of the necessary steps in order to close a sale successfully.

How To Set Up An Appraisal Of A Property In Probate In Illinois

When selling a house in probate in Illinois, it is important to set up an appraisal of the property in order to determine its market value. The executor of the estate should hire a certified appraiser who is licensed by the state to carry out the appraisal.

The appraiser will inspect the home and assess its condition, features, and amenities before determining its worth. They will also take into consideration any recent repairs or upgrades that have been made on the property.

Additionally, they may look at comparable homes in the area to ensure that they provide an accurate estimate of what the home might fetch on the open market. After all of this data has been collected, the appraiser will use it to compile their findings and generate an appraisal report for submission to potential buyers or listing agents.

With a thorough appraisal report in hand, sellers can then make informed decisions about how much to list their home for sale.

Overview Of Laws Relating To Disposition Of Real Estate In An Estate In Illinois

Selling a house in probate in Illinois requires knowledge of the laws and regulations relating to the disposition of real estate in an estate. In order to successfully complete the process, it is important for executors and beneficiaries to understand their rights and responsibilities under the law.

Generally speaking, Illinois law allows for an executor or other fiduciary acting on behalf of an estate to sell real estate without court approval as long as the sale price is fair market value and all interested parties are given notice of the proposed sale. However, if any interested party objects to the sale, then a court must approve it.

Additionally, certain taxes are due at closing when selling a house in probate in Illinois, including transfer tax, capital gains tax (if applicable), inheritance tax (if applicable), and deed stamps. Executors should also be aware that they may have personal liability if they make unauthorized distributions from the estate or fail to pay liabilities out of it.

It is, therefore, essential that they consult with legal counsel before taking any action related to selling a house in probate in Illinois.

How To File The Appropriate Documents In An Estate For The Sale Of Real Property In Illinois

The process of selling a house in probate in Illinois can be complicated and time-consuming, but by following the right steps and filing the appropriate documents, it is possible to complete the sale successfully. The first step is to ensure that you have an original copy of the death certificate of the deceased person who owned the property.

Next, you need to obtain Letters Testamentary or Letters of Administration from the court. These documents are necessary for authorizing any real estate transactions during probate and must be filed with the court before any offers can be accepted or contracts signed.

After these documents have been obtained, a Petition for Sale must then be filed with a local circuit court. This petition must include a detailed description of the property, including its address, size, and boundaries.

Additionally, a copy of title and proof of ownership must also be provided in order to prove that all heirs agree to the sale. Once all required paperwork has been filed with the court, you will then need to obtain an Order for Sale from a judge, which will authorize an official sale agreement between interested buyers and sellers.

Following these guidelines should help make sure that all documentation is properly completed when selling a house in probate in Illinois.

How To Market A Property Going Through Probate In Illinois

Marketing a property going through probate in Illinois is challenging, but some strategies can help make the process easier. To start, it’s important to understand the probate process and the rules and regulations that apply in Illinois.

Once you have a good grasp of probate law, you can begin marketing your property. You’ll want to highlight the house’s unique features and appeal to potential buyers who may be interested in purchasing the estate.

Additionally, you should consider using professional real estate agents who specialize in selling properties in probate. They will be able to provide advice on pricing, staging, and listing techniques that will help get your property sold quickly and for top dollar.

Online marketing is also another effective tool for reaching potential buyers. Utilizing social media platforms such as Facebook, Twitter, Instagram or YouTube can help spread the word about your home while getting maximum exposure on the web.

Lastly, it’s important to build relationships with local lenders who are familiar with the probate process and may be willing to work with buyers looking to purchase an estate home in Illinois. With these strategies combined, you can successfully navigate the marketing process of a property going through probate in Illinois.

What Are The Steps For Closing On A House After A Probate Sale In Illinois?

When selling a house in probate in Illinois, there are several steps to follow in order to close on the sale. The first step is for the executor or administrator of the estate to obtain court authorization to sell the house.

This requires applying with the local probate court. Once the court approves the sale, it will issue Letters of Office, which are necessary for closing.

Next, a real estate agent should be hired to list and market the property. Before signing a listing agreement, it’s important to review fees and commission structures and decide whether an auction or traditional listing is best for the situation.

After listing, buyers should be screened, and offers accepted or rejected accordingly. Once an offer has been accepted, a contract should be drafted that outlines all of the relevant terms, including purchase price, closing date, and other contingencies.

It’s also essential to obtain title insurance so that all parties involved can rest assured that there are no outstanding liens on the property. Finally, once all paperwork has been signed at closing, funds from the sale should be distributed according to state law governing estates in Illinois.

Dealing With Tax Liens On A Property Sold During Probate In Illinois

When selling a house in probate in Illinois, tax liens must be taken into account. Tax liens are legal claims that the government makes against a property when the owner owes delinquent taxes.

When dealing with a probate sale, it is important to know that any existing tax liens must be paid off prior to closing the sale. The estate’s executor or administrator will need to contact the county assessor’s office and request copies of the lien certificates for all outstanding liens involving the property being sold.

Once received, they will need to contact each lienholder and negotiate payment terms for each certificate. If payment cannot be made in full at closing, then arrangements will need to be made to pay off the remaining balance of each lien as soon as possible after closing.

It is also important to remember that penalties and interest may have accrued on unpaid taxes during probate, so make sure you research any applicable laws before entering into negotiations regarding payment terms.

Tips For Negotiating With Buyers During The Probate Process In Illinois

When selling a house in probate in Illinois, it is important to be aware of the negotiation process that will take place with potential buyers. The goal should be to reach an agreement that is fair and beneficial for both parties.

To ensure this happens, sellers should familiarize themselves with the probate laws in Illinois and research the real estate market before listing the property. It is also important to understand the buyer’s perspective and any special considerations they may have when entering into negotiations.

A good strategy for sellers is to create a list of priorities so that all terms are discussed openly and fairly. Additionally, sellers should negotiate from a position of strength by understanding their own rights as well as those of the buyer.

Sellers should also remain flexible during negotiations by being willing to compromise on certain points in order to reach an agreement quickly. Finally, using an experienced real estate agent or attorney can help ensure that all legal requirements are met during the negotiating process and that a fair agreement is reached between both parties.

When selling real estate during probate, it is important to ensure that all beneficiaries are represented. This can become more complicated when there are liabilities attached to the property or when joint ownership of the real estate exists.

It is important to understand the fees associated with selling a home during probate and potential solutions if there is not enough money from the sale to pay debts and taxes associated with the estate. It is paramount for anyone navigating these complexities to stay up-to-date on Illinois laws regarding the administration of an estate and any applicable taxes.

For those who need assistance, we offer a FREE E-Book that will help guide you through the process of selling a home during probates.

Who Owns A House During Probate In Illinois?

In Illinois, when a person dies and leaves behind property, their estate must go through the probate process. During this period of time, the court is responsible for determining who owns the deceased person’s possessions.

In most cases, this includes real estate, such as a house. In Illinois, when a house is in probate, ownership is determined by the provisions set forth in the will of the deceased person.

If there is no will or if it does not include instructions regarding ownership of a particular property, then ownership passes to the heirs according to state law. It should be noted that any debts owed by the deceased must be paid before ownership of the house can be determined.

Once ownership has been established during probate in Illinois, selling a house can be accomplished in accordance with state laws and regulations.

How Long Does A House Stay In Probate In Illinois?

In Illinois, the length of time a house stays in probate typically depends on the complexity of the estate and how quickly the estate is processed. Most estates take between 6 and 12 months to complete probate, though certain factors can prolong this process.

A few of these factors include whether or not there are outstanding debts that need to be settled, any disputes among heirs over who has rights to the property, and if there is a will or other instructions concerning the distribution of assets. The executor of the estate is responsible for ensuring that all legal aspects of the probate process are properly taken care of in order to expedite its completion.

Selling a house while it’s in probate is possible; however, it requires legal expertise to ensure the process moves as quickly as possible so potential buyers can purchase it. Family members may also have certain rights regarding inheritance that must be taken into consideration prior to selling a house in probate in Illinois.

How Do I Close A Probate Estate In Illinois?

Closing a probate estate in Illinois can be a complicated process, so it’s important to understand the steps involved and what strategies are available for selling the house. In general, the executor must submit an inventory of all assets with the court, obtain appraisals of any real estate that is part of the probate estate, pay any outstanding debts or taxes that are due, and then distribute the remaining assets according to the terms of the will.

The executor also has to file a petition for distribution with the court and receive approval before distributing assets to heirs. When it comes to selling a house in probate in Illinois, one strategy is to hire a real estate agent who specializes in selling homes in probate.

This can help streamline the process by providing access to potential buyers as well as advice on how best to market the property. Additionally, hiring an attorney experienced with probate law can provide additional guidance throughout this process and help ensure everything is properly handled according to state laws.

With these strategies helping you navigate through closing a probate estate in Illinois, you can rest assured that everything will be handled correctly and efficiently.

How Long Does An Executor Have To Settle An Estate In Illinois?

In Illinois, the executor of an estate has six months from the date of death of the decedent to settle an estate. This time frame is set out in the Probate Act of 1975.

During this time, the executor must complete a number of tasks related to settling the estate, including inventorying and appraising assets, paying outstanding debts, filing tax returns, and distributing assets to beneficiaries. An executor may be able to extend this deadline if they can show good cause for doing so.

When selling a house in probate in Illinois, it is important to factor in this timeline when creating strategies for selling the home. The executor will need to make sure that all tasks associated with settling the estate are completed before proceeding with a sale.

Q: What is a Petition for Probate in the context of selling a house in Illinois belonging to a deceased person (decedent)?

A: A Petition for Probate is a formal request to the court to appoint an executor or administrator of the decedent’s estate, who will be responsible for distributing assets, including any real property such as a house, and legacies to heirs and legatees.

Q: What are the levies associated with selling a house in probate in Illinois?

A: In Illinois, the levies associated with selling a house in probate include filing fees for the Petition for Probate and an Heirship Determination, as well as any taxes due on the property.

Q: What do I need to do to sell a house in probate in Illinois?

A: To sell a house in probate in Illinois, you should research the probate laws in Illinois and understand the process of selling a house in probate. You should also hire an attorney or lawyer experienced in probate law and gather the necessary documents for the sale. Additionally, you may need to file a Petition for Probate with the court if the decedent has died within the past two years.

Q: How can I market the property to potential buyers when selling a house in probate in Illinois?

A: To market the property, you should research the recent sales prices of comparable properties in the area. You can also advertise the listing online on real estate websites or through a local real estate agent. You should also consider hosting open houses and other forms of marketing to attract potential buyers.

Q: What are the legal requirements for selling a house in probate in Illinois?

A: The legal requirements for selling a house in probate in Illinois include filing a Petition for Probate with the court, appointing an Executor to manage the estate and administer the sale of the property, and obtaining Letters of Office from the court. Additionally, any debts or liens owed by the decedent must be paid before the sale can be completed.

Q: What is required of the testator when selling a house in probate in Illinois?

A: When selling a house in probate in Illinois, the testator must provide proof of ownership, such as a deed or will, to the court. The court must then approve the sale and issue a receipt for any cash received from the sale.

Q: How can a REALTOR or REAL ESTATE BROKER help with the sale of a house in probate in Illinois?

A: A REALTOR or REAL ESTATE BROKER can provide guidance and assistance throughout the process, including helping to secure certain bonds that are required to be insured. They will also be able to ensure that all necessary legal requirements are met and assist with filing the Petition for Probate if necessary.

Q: How does the income of the decedent’s spouse affect the valuation of a house in probate in Illinois?

A: If the decedent’s spouse is an heir and has been living in the house, their income may be taken into account when determining an appropriate valuation for the house. This is because spousal rights can give them a legal claim to continued occupancy or a share of proceeds from any sale.

Q: What are the federal estate taxes associated with selling a house in probate in Illinois?

A: Selling a house in probate in Illinois may involve paying federal estate taxes, depending on the value of the estate. Generally, estates worth more than $11.2 million are subject to federal estate taxes.

Q: How can I research probate laws in Illinois related to selling a house in probate?

A: To research probate laws in Illinois related to selling a house in probate, you should consult with an attorney who specializes in estate law. Additionally, you should look for available online resources such as state websites and legal guides. These resources can provide more information about the process of selling a house in probate and the legal requirements that must be met. It is also recommended to hire an attorney to help with the sale of the property and gather any necessary documents or information needed for the sale.

Q: How can I advertise the property for sale when selling a house in probate in Illinois?

A: In Illinois, the executor or administrator of the estate is responsible for advertising the property for sale. This can be done by posting notices in public places and/or placing advertisements in local newspapers. Additionally, a real estate broker or agent can assist with listing the property on various websites and marketing it to potential buyers.

Q: What are the tax implications of selling a house in probate in Illinois?

A: When selling a house in probate in Illinois, the executor of the estate must pay taxes on any gain realized. This includes any capital gains taxes and inheritance taxes, which may apply depending on the state. Additionally, the executor is responsible for filing all necessary tax returns associated with the sale, such as federal and state income tax returns.

Q: How can I advertise the property when selling a house in probate in Illinois?

A: Advertising a house for sale in probate in Illinois requires one to comply with the applicable state laws. In order to be able to advertise the property, a Petition for Probate must first be filed with the local court. After that, it is possible to advertise the property by placing an ad in newspapers or other publications, posting signs around the neighborhood, and/or creating an online listing on websites like Zillow or Trulia. A REALTOR or REAL ESTATE BROKER may also help with advertising the property.

Q: What are some strategies for selling a house in probate in Illinois?

A: It is important first to understand the legal requirements for selling a house in probate in Illinois, which involve filing a Petition for Probate with the court. A REALTOR or REAL ESTATE BROKER can help facilitate the sale of the property and provide advice on market value and current trends. Additionally, it is important to research applicable probate laws in Illinois to ensure that all steps are followed correctly throughout the process. Lastly, it is important to consider any potential tax implications associated with selling a house in probate in Illinois before finalizing the sale of the property.

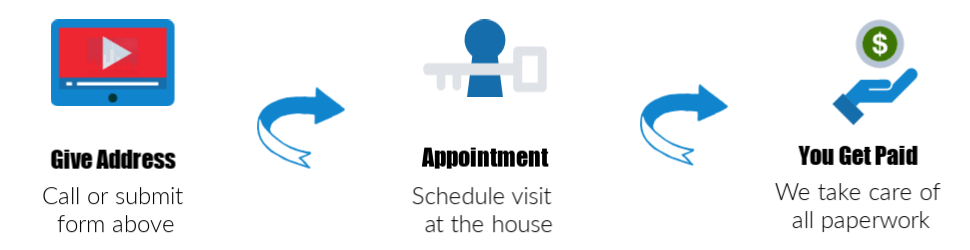

What Do You Have To Lose? Get Started Now…

We buy houses in ANY CONDITION in Chicago. There are no commissions or fees and no obligation whatsoever. Start below by giving us a bit of information about your property or call (224) 549-2260 …

| DECEDENTS | LEGACY | STATE OF ILLINOIS | ATTORNEYS | LAWYERS | CHILDREN |

| CHILD | PERSONAL PROPERTY | PERSONAL ESTATE | REALTORS | SIBLING | DEATH TAX |

| TENANTS | LANDLORD AND TENANT | GIFT | PROBATE COURTS | MORTGAGE | MORTGAGE LENDER |

| BENEFICIARY | LITIGATION | LAWSUITS | INVESTOR | EXPENSES | TRUST |

| HELD IN TRUST | PHONE | REAL ESTATE INVESTOR | INTERESTS | INCOME TAXATION | EXEMPTION |

| PROPERTY TAX | OPTIONS | STOCK OPTIONS | “INTESTATE” | IBUYER | FRAUD |

| ESTATE PLANNING | DISCLOSURE | CONSENT | COMPANY | AUTOMOBILES | |

| BANK | THE UNITED STATES | MEMORIES | MEMORY | WEDLOCK | DIVORCE |

| TO SELL THE PROPERTY | THE PROBATE PROCESS IS |

Donald Montoya, Satisfied Customer in Midlothian.

Donald Montoya, Satisfied Customer in Midlothian.

Alfred Richardson, Satisfied Customer in Olympia Fields.

Alfred Richardson, Satisfied Customer in Olympia Fields. Lisa Porter, Satisfied Customer in Naperville.

Lisa Porter, Satisfied Customer in Naperville.